Vosper: “E-bikes step up in a down market”

118 days ago

3 minutes

Source: Bicycle Retailer

2023 wasn’t a great year for the e-bike market, with high inventory & low sales, and struggling relationships between suppliers and retailers. This is unlikely to improve in the immediate future.

Decreased Imports

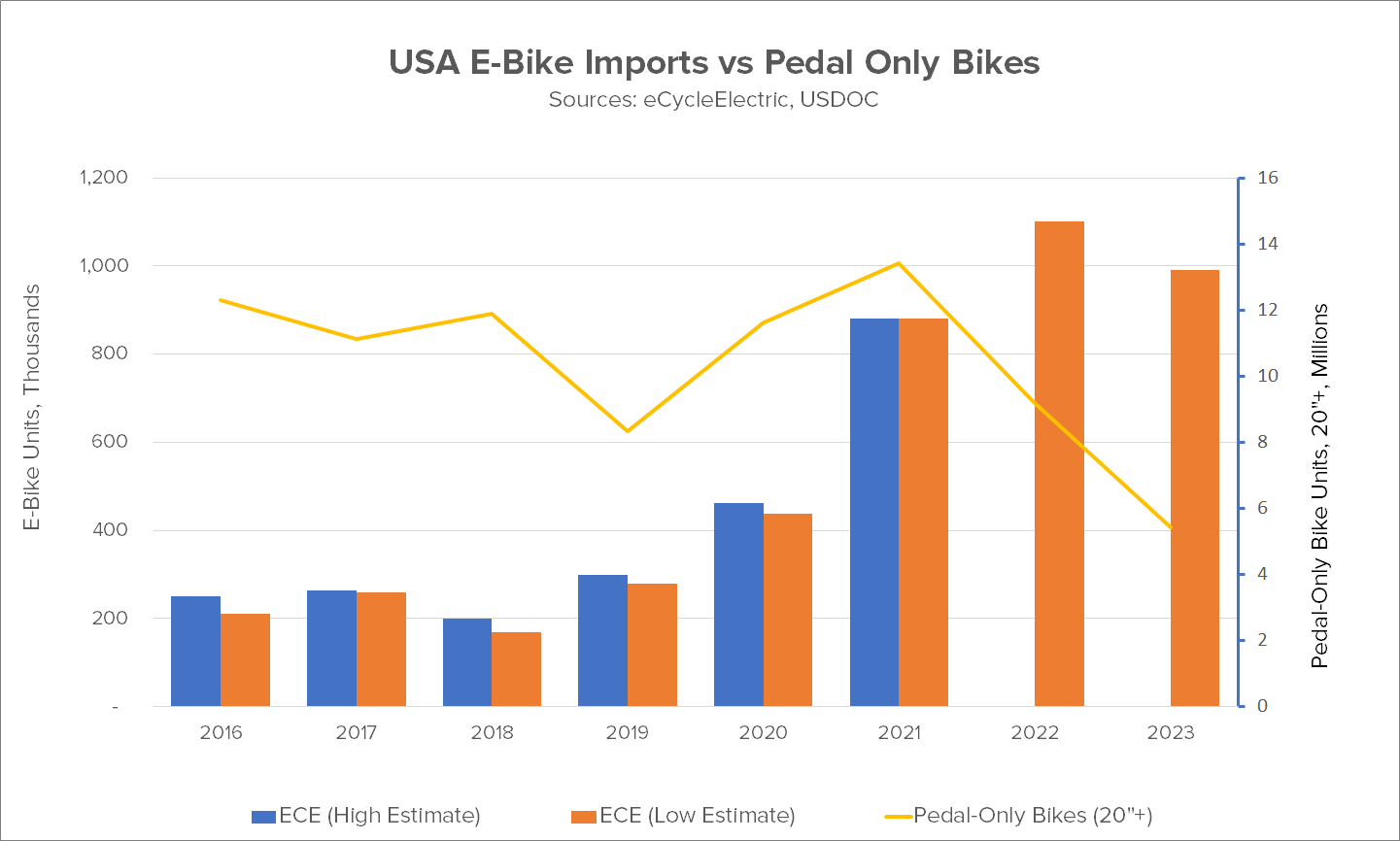

A recent analysis by Rick Vosper in Bicycle Retailer shows that the number of imports for both classes of bikes fell significantly in 2023 (Figure 1) as suppliers attempted, and succeeded in, decreasing the number of orders in the pipeline.

Pedal only bike imports for 2023 were down by 41% from 2022, which itself was down 31% from 2021. In 2023 5.3 million units were imported, which represents the lowest number of pedal-only imports since the first recorded year in 1981. To compare, e-bike imports were 990,000, down 10% from 2022, which represents a 25% increase from 2021.

Source: eCyclceElectric & U.S Department of Commerce (USDOC)

Not only that but e-bikes are steadily gaining market share, from 2% in 2016 to more than 18% of pedal-only bike sales in 2023 (Figure 2). This increase inversely correlates with the decrease in pedal only bike imports.

Some have speculated that when e-bike imports reach 20% of pedal only, it will mark an infection point for e-bike sales in the U.S., and that a large increase in market share will happen as a result.

However, Vosper disagrees commenting “I am sceptical of this projection. Here’s why: some large majority of e-bike sales are in the very bottom of the mass market as low-end bikes shipped D2C from China and other Asian manufacturers. These units have no direct parallels in the pedal-only market segment, so there’s no basis for an apples-to-apples comparison, which renders that 20% number arbitrary. To really see the relationship, we’d have to look at dealer and mass retailer sales and filter the bottom feeders out of the equation somehow. At present I don’t believe the industry has the resources to do this.”

An ongoing problem

Despite the cuts in imports in 2022 and 2023, there’s still inventory excess due to the huge number of imports during the years of COVID (2020 & 2021), this indicates that the inventory excess is a long-term problem. On the bright side, e-bikes seem to be doing better than other product categories. In an informal poll on the Facebook group Cycling Industry Recover, 56% of retailers reported that their e-bike sales are up relative to their pedal only models. Perhaps this is indicative of future buying trends.

LEVA EU

Campaign success

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Member profile

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.