India’s electric two-wheeler startups boom

112 days ago

3 minutes

India’s electric two-wheeler market is experiencing a surge in startups, climbing from 54 in 2021 to over 150 in recent times. This growth is partly thanks to government incentives aimed at promoting clean vehicles and reducing fossil fuel imports.

Source: Techcrunch

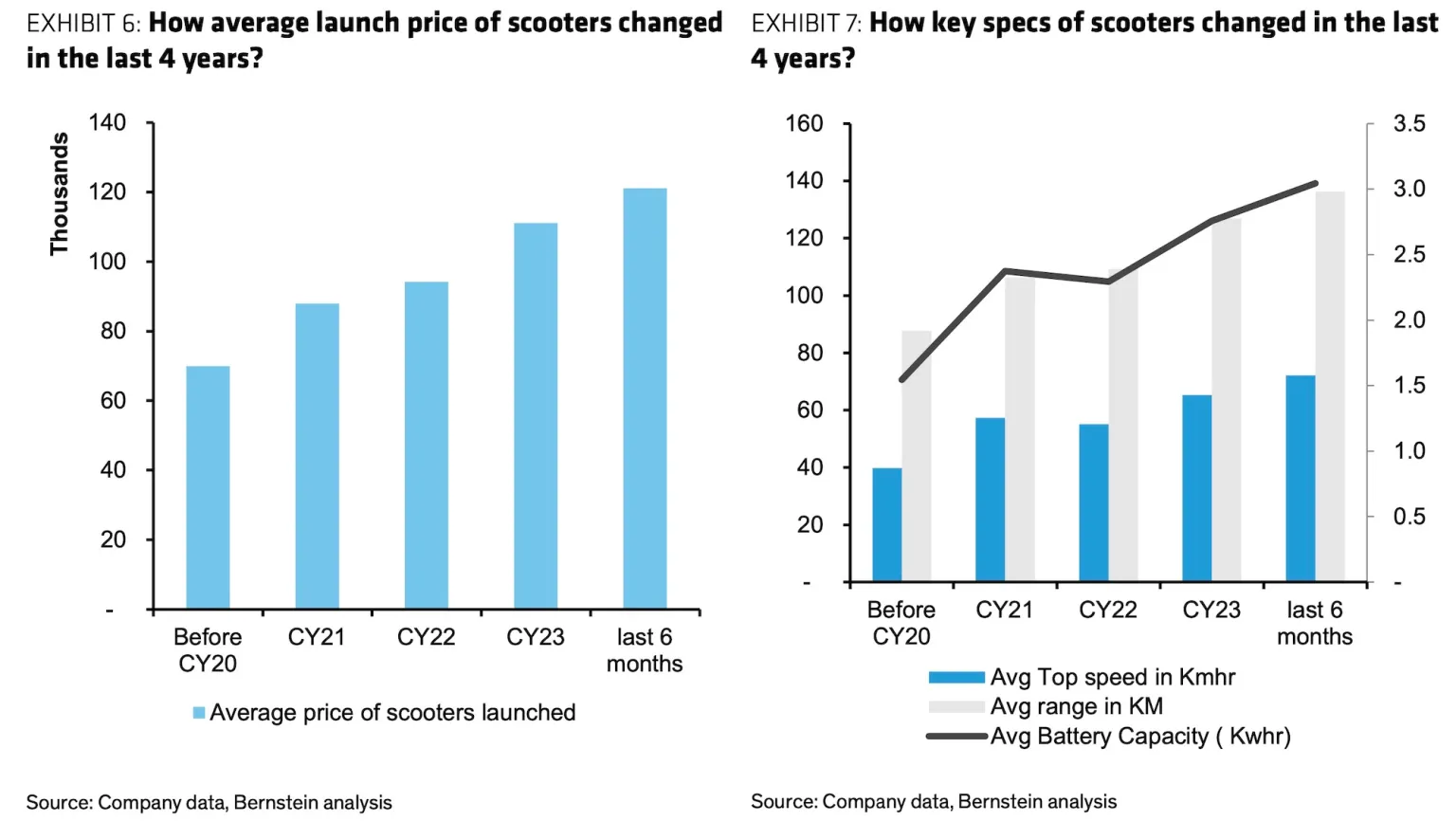

An analysis by Bernstein forecasts continued expansion, projecting annual sales of 15-20 million units over the next decade, marking a 15-20 times increase. This surge in startups has fostered intense competition, particularly in the mainstream segment, where 85% of the 65 models launched last year showcased high-speed capabilities, a departure from previous limited offerings.

The average battery capacity of newly launched models has also seen a notable rise, from 2.3kWhr in 2022 to 3kWhr. India’s ambitious goals of achieving 30% electric vehicle penetration by 2030 and net-zero carbon emissions by 2070 are driving these developments.

Key to this momentum is the government’s FAME II scheme, providing subsidies to buyers, being recently extended to 2024. Despite a reduction in subsidies in mid-2023, the number of electric two-wheeler companies continued to climb, reaching 152 by January 2024. Importers, particularly sourcing components or entire vehicles from China, have significantly contributed to this rise.

While startups dominate the top ranks, led by Ola Electric, accounting for 39% of the market share as of January 2024, sales volumes remain concentrated among the top five players, comprising 85% of the market. Moreover, low barriers to entry, reliance on outsourced models, and readily available components characterize the industry landscape, with only half of the founders possessing engineering backgrounds.

As the industry matures, the government is moving towards production-linked incentives (PLI) favouring domestic manufacturing. While established automotive giants have largely secured PLI benefits, only a handful of startups have qualified, potentially providing cost advantages to major incumbents.

Looking ahead, Bernstein’s analysis anticipates room for five startups to emerge as significant players alongside established companies. Nonetheless, intense competition could temper industry profit margins and returns in the medium term.

LEVA EU

Campaign success

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Member profile

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.