Ceci n’est pas un cas de dumping. (This is not a dumping case)

2160 days ago

10 minutes

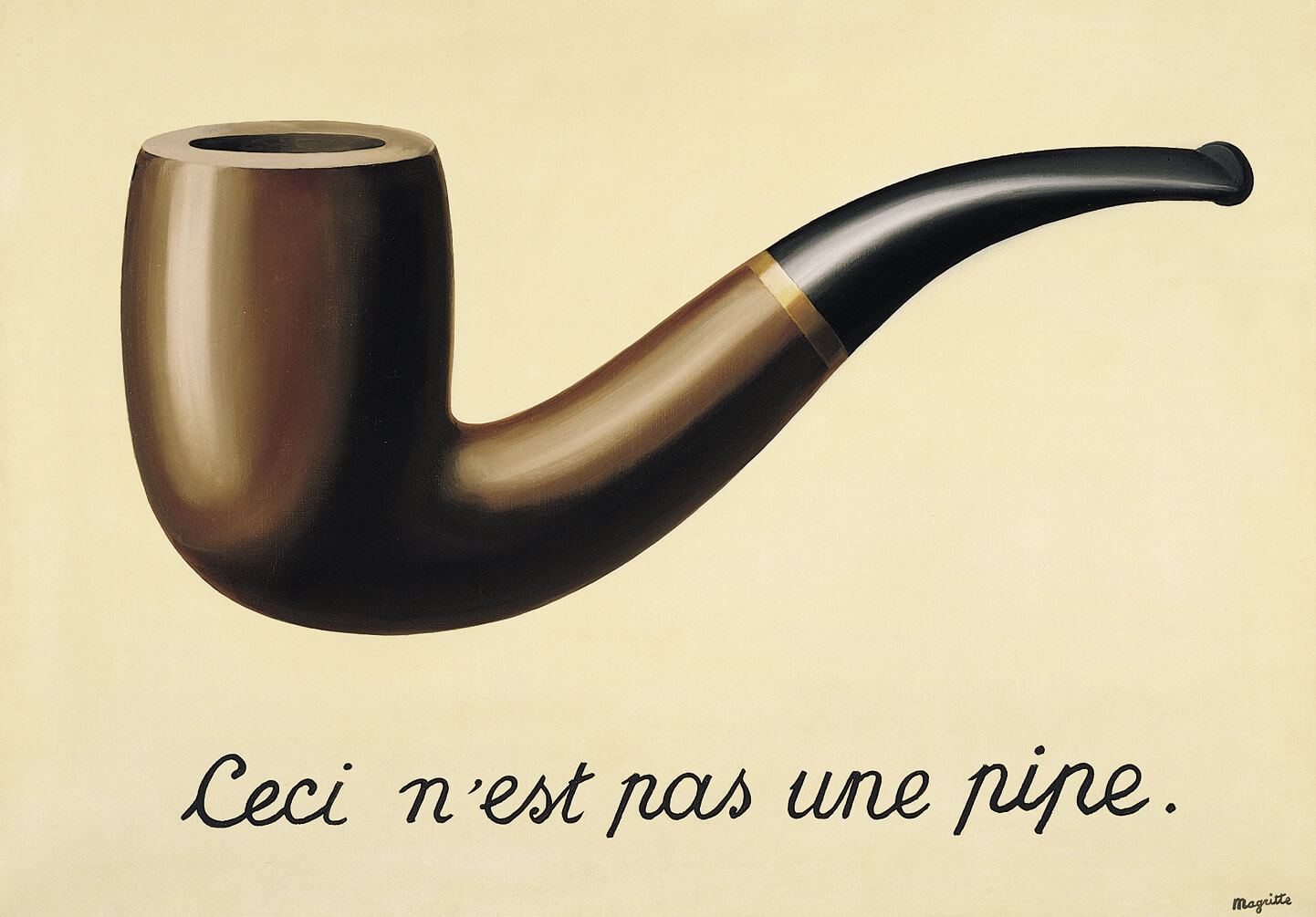

René Magritte’s painting, “Ceci n’est pas une pipe”, caused quite a stir at the time. Magritte stated that he would be lying if he called it a pipe because his painting was only a representation of a pipe. By analogy with Magritte, the dumping case against electric bicycles from China should not be called a dumping case, but a representation of a dumping case. However, truth needs to be more and more touched up to make it resemble a dumping case. This is again apparent from the Regulation of 18 July through which the European Commission has imposed provisional duties. A selection of the incongruities in that text, against which the Collective has officially protested once again.

For now, the Commission concludes that electric bicycles from China are being dumped and that European industry suffers injury as a result. The extent of the injury is such that provisional duties are necessary to prevent further deterioration.

Expressed in figures, the “damage” to European industry from 2014 to 30 September 2017 is as follows:

– Sales volume: + 21%

– Production volume: + 29%

– Production capacity: + 35%

– Capacity utilization: -4%

– Employment: + 40%

– Labour costs: -10%

– Profitability: + 25%

– Investments: + 77%

– Return on investment: + 103%

As for the only negative result in this list, capacity utilization, the Commission itself states that the relevance of this indicator is limited because production lines can be used for both conventional and electric bicycles (recital 172).

Fitting the numbers to the story

Against all logic and sense, the Commission has managed to conclude from all the above that the European industry is suffering injury. This is how the system apparently works. Whilst, according to the Regulation, the sales volume of the European industry increased by 21% between 2014 and 30 September 2017, total consumption grew by 74%. As a result, sales’ share of the European industry declined in theory from 76% to 53% in that period, and that was due to the alleged harmful, growing imports from China, according to the Commission.

With that however, it appears that figures are sometimes inexplicably adjusted upwards or downwards to fit the story of injury. One obvious example of this is profitability mentioned in recital 192. The Commission interprets the evolution of this indicator as follows: “Starting from a low base of 2,7 % in 2014, profits margins eroded from 4,3 % in 2015 to 3,4 % in the investigation period.” (Recital 194) If an increase of profit margins by 25% is referred to as “eroding“, then one must seriously question whether any argument can be raised at all against the Commission’s determination to prove dumping.

Mathematically impossible

But there’s more. The Commission does not mention what profitability has been established at the verification visits of the sampled producers. These percentages are shown in the table below.

| 2014 | 2015 | 2016 | IP | |

| Accell Group | 100 | 194 | 223 | 189 |

| Derby Cycle Holding GmbH | 100 | 148 | 204 | 193 |

| Eurosport DHS SA | 100 | 707 | 2,222 | 2,795 |

| Koninklijke Gazelle NV | 100 | 431 | 236 | 332 |

| Prophete GmbH & Co. KG related company to Eurosport DHS SA | 100 | 68 | 81 | 118 |

| % Profit Determined in Provisional Regulation | 100 | 160 | 142 | 125 |

Source: EU Sampled Producers Questionnaires After Verification

The above stated profitability of Accell, Derby and Konkinklijk Gazelle is set out in the graph below.

Chart 1: Comparison of Profitability Trends Reported by the Sampled EU Producers Compared to Profitability Established in the provisional Regulation (IIP)

Source: EU Sampled Producers Questionnaires After Verification and Provisional Regulation Table 11

Index 2014 = 100

This graph clearly shows that an increase of only 25%, as stated by the Commission, is mathematically impossible. The lack of consistency permeates the whole Regulation and reaches a culmination in recital 177 where the Commission concludes that “The Union Industry had to reduce its production, sales, employment and capacity between 2016 and the investigation period due to dumped imports from the PRC.” Once again, we question why the Commission makes a comparison between 2016 and the investigation period. In that period, production declined by a modest 1.7%, sales by 3%, production capacity by 9.2%, while employment grew by 1.8%. For the entire period however, these factors were respectively 29%, 21%, 40% and 35% higher on 30 September 2017 than on 1 January 2014.

More inconsistent numbers

In addition to the fact that several numbers in the complaint and the Regulation do not match, there is also an inconsistency in the production figures used. Nevertheless, both the Regulation and the EBMA complaint refer for these to the same source: EBMA’s sister organization CONEBI. In its very first position, the Collective has pointed out this inconsistency, but has never received any response to this.

| EU Industry Production | 2014 | 2015 | 2016 | IP |

| CONEBI website | 1,030,000 | 1,164,000 | ||

| EBMA complaint | 856,000 | 1,023,000 | 1,004,000 | 1,025,000 |

| Regulation | 842,531 | 987,111 | 1,108,087 | 1,089,541 |

| EBMA complaint index | 100 | 120 | 117 | 120 |

| Regulation index | 100 | 117 | 132 | 129 |

Prejudiced Commission

Another remarkable finding in the Commission’s Regulation, in the framework of the injury to the European industry is that during the investigation period four European producers have gone bankrupt. This is communicated at the end of recital 204, which provides details of the detrimental effects of Chinese dumping on European producers. In fact, in this Regulation, the Commission insinuates twice that the bankruptcies are the result of dumping. Since the Commission omits to mention who the manufacturers concerned are, it is impossible to check this statement for accuracy.

With this, the Commission proves itself prejudiced and not for the first time. In the Registration Regulation for instance (Recital 14), the Commission argued that the importers were are or should have been aware that there was dumping at the start of the proceeding. Hence, the Commission implies in no uncertain terms that there is effective dumping at a moment when the investigation is still in full swing. This means, therefore, that the accused are found guilty before their guilt has been proven, which is in direct contradiction to the indisputable legal principle that someone is innocent until proven guilty.

Commercial advice

Under the heading “6.3.Interest of unrelated importers” there are some further remarkable points. The Commission extensively argues that for importers of electric bicycles from China, the alternatives for supply are plentiful. Of the 450 bicycle manufacturers in Europe, there are still only 37 who produce electric bicycles. In other words, there are hundreds of European bicycle producers left who could help out the importers, whilst the 37 existing electric bike producers can still allegedly expand their capacity. What’s more: “The import statistics show that Vietnam and Taiwan supplied substantial quantities of electric bicycles to European importers. It is also likely that other countries with a strong position in the production of ordinary bicycles could potentially supply importers.” (Recital 239) This despite the fact that the Commission could not find a single producer from any of these countries to cooperate and provide data to assist it in the dumping calculations.

An objective analysis in a dumping case does not, in our view, require commercial advice to affected importers. A dumping procedure is an instrument to remedy a temporary abuse in international trade, not to convince importers to stop supplying themselves from the accused country! This is not the first time that importers are confronted with such commercial advice from the Commission.

Obstinate refusal

In doing so, the Commission once again ignores the information provided by the Collective on the relationship between the importers and their suppliers in China. These importers develop, brand and market their own bicycles, which they have produced in China, because a complete supply chain is available there and because they have built relationships with their suppliers for many years. Consequently, the Commission refuses to apply the necessary adjustments in order to calculate normal value and obstinately adheres to the OEM level of trade: ” (…) the Commission did not find any consistent and distinct difference in functions and prices of the Union industry between their OEM and non-OEM sales on the Union market at the level of product types, within the meaning of Article 2(10)(d)(i) of the basic Regulation. Article 2(10)(d)(ii) of the basic Regulation was equally inapplicable as the relevant level of trade – OEM – does exist on the domestic market of Union producers.” (Recital 115) We repeat that the sample of EU producers consists of Accell, Gazelle, Derby and oh, yes, Eurosport with its related importer Prophete, which was included without further explanation after the sample of producers was decided on and communicated.

65 companies, 1,000 people

The Commission puts forward further arguments for the claim that there are few reasons for importers to worry: the imposition of duties could only “have an adverse effect on a number of mainly small importers” (Recital 242). Upon publication of the Registration Regulation, LEVA-EU carried out a small Internet survey about possible injury caused by the proceeding to importing companies. 72 companies have completed the survey of which 65 (= 90%) confirm that the proceeding is causing actual damage to their business. The reported damage is significant and diverse:

- Almost 42% is short of product to sell, in the height of the season;

- 39% state that they already had to increase the price of their products;

- 5% have suffered financial loss since the initiation of the dumping proceeding;

- 33% have stopped import of electric bikes from China and have not found an alternative solution;

- 6% state that their company will have to close down if retro-active collection is imposed;

- 21% will not continue if definitive duties are imposed;

- Almost 21% had to lay off staff.

According to the Commission, the EU Industry currently consists of 37 companies. It is difficult to understand how stated damage to 65 companies, employing more than 1,000 people can be so simply dismissed by the Commission with the cursory understatement that final duties “could have an adverse effect on a number of mainly small importers”. Furthermore, the damage is occurring now, while the proceeding is ongoing and the accused have not been found guilty yet.

Injury kept quiet

Ceci n’est pas un cas de dumping. This is a political game which fits with the current, general European attitude to discourage trade with China. Furthermore, a very small number of large companies in Europe try, through abuse of trade defence instruments, to push competition out of those markets they have lost out on due to their own rigidity and short-sightedness.

On the 20th July, Bike Europe reported on Accell’s outlook for the rest of 2018 as follows: “Accell Group expects continued turn-over growth in the second half of 2018, driven by higher sales or e-bikes and high-end regular bikes. Working capital at year-end 2018 is expected to be a major improvement, compared with the end of June 2018.” And CEO Ton Anbeek commented: “Based on these developments, we expect the group to record an increase in net turn-over and a higher operating result for the full year 2018, barring unforeseen circumstances.”

If there is injury to the European industry through dumping, then surely Accell must be among the most injured. How is it that Ton Anbeek, or any other Accell, Derby, Cycleurope, Decathlon, … executives, in their business analyses for the press, have never mentioned this with one word? Perhaps the press should finally ask them that question.

In the meantime, the Collective is continuing its fight against this case. The group has requested a hearing with the Hearing Officer with a view to addressing the infringement of their right to defence in this and previous Regulations. Furthermore, the Collective is awaiting a decision on the admissibility of the lawsuit initiated against the European Commission.

Annick Roetynck,

LEVA-EU Manager

(The above image represents a painting by René Magritte, which represents a pipe)

The Dutch version of this article is available here:

https://www.dropbox.com/s/75pagdcg7q9z1vt/PR%202018%20-%20Provisional%20duties%20NL.docx?dl=0

Annick Roetynck

Annick is the Manager of LEVA-EU, with decades of experience in two-wheeled and light electric mobility.

Campaign success

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Member profile

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.